Ask anyone about the key characteristics of a successful investor, the term "independent thinking" almost always comes up. This is very reasonable since a successful investor has to make contrarian bets in which the odds are mis-priced. And if you do not think independently, you will be easily swayed by the market and hence have limited ability to identify money-making opportunities, which by definition are non-obvious. Given the underperformance of most active managers, independent thinking seems to be a rare resource. But why is this the case? Taking a step back, what does it really mean to be an "independent thinker"? More importantly, is it a quality that is inborn or can it be nurtured? As we are all striving to become better investors, I think the following question is worth pondering on: How can we become better "independent thinkers"?

I have been contemplating this very topic over the past month. In this short essay, I explore (or more like recap) the concept of independent thinking, share my thoughts on what independent thinking entails, what it is not, and in my humble opinion, how we can all improve as independent thinkers.

Anatomy of Independent Thinking

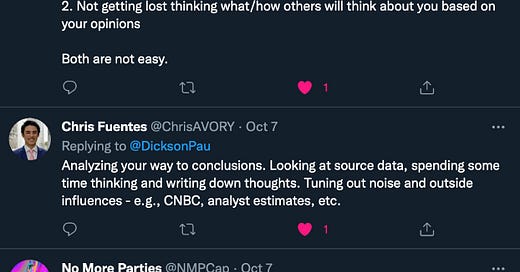

Two weeks ago, I tweeted the following question and received four replies, which together I think capture the meaning of independent thinking quite fully.

MBI set the stage for us. Independent thinking has long been associated with "Thinking based on first principle". This means going through the logic flow, establishing how an argument goes from A to B to C and so on, before moving all the way to Z. This is what Chris meant by "analyzing your way to conclusions" and why looking at data sources is important. Ultimately, first principle thinking is really just breaking down a topic into subtopics and examining each in a logical way. This all sounds very simple. Therefore, in a sense, the rarity of independent thinking ought to come as a surprise. Everyone with an average intelligence capable of logical deduction should be able to "think independently". (The level of intelligence influences the ability to reason correctly or come up with better explanations. But independent thinking does not necessarily mean being correct. Otherwise, no one in the financial markets are true "independent thinkers", given the high failure rate in investing. And in most real-life situations, we are not asked to solve calculus. One just needs to be logical. Correctness should not be part of the measurement of independent thinking.) In reality though, there is often a sense that only a small group of people are capable of thinking independently. Why is this the case?

Before I share my own thoughts, let me first highlight what independent thinking is not: Original thinking. I do believe original thinking is a rarity. The paragon of original thinkers, in my opinion, include people like Galileo, Einstein, Darwin, etc. These truly groundbreaking scientists, through their imagination and reasoning, imposed on all of humankind a completely new way to interpret the world. This however is not the case for even the greatest investors. From Buffett to Soros, and so on, they are all followers of certain existing principles. Buffett is the most famous student of Ben Graham and Soros is a disciple of Karl Popper. The difference between them and an average investor does not come from originality. Going against the crowd does not require the conjuring of bending space and time.

If Originality is Not the Limiting Factor, then What Is?

When we read analyst reports or a piece of opinion on the FT, we are absorbing the analysis and judgement from another person. Essentially, we jump directly to Z. While the work may be beautifully articulated and the arguments made based on underlying data points, the integrity of the analysis cannot be guaranteed. The data could have been interpreted incorrectly, or worse still, flawed data were used, or part of the data set was ignored. To fully assess the analysis, one would therefore need to directly inspect the most fundamental level of arguments, the data points. This, however, presents a challenge. The cost of examining the accuracy of data and figuring out if they are collected without any biases is high and doing so for every argument presented to you is prohibitive. Instead, we need to treat this as an optimization problem, and choose an optimal point between efficiency and effectiveness. Where a problem belongs on this continuum depends on the seriousness of the subject on hand. If you are just deciding whether a restaurant is worth trying, it is unlikely to be imperative that you understand how your friend came up with the recommendation. But when it comes to whether you should take an experimental drug for your illness, then you probably want to dig deeper into the reasoning and proof of various recommendations to make the best decision. Most problems occur when it comes to a decision that is somewhere in between these two extremes. Given our human nature of laziness, unless the issue on hand is a matter of life and death, we tend to optimize our mental activities for efficiency rather than effectiveness. I believe this is why independent thinking is hard to come by in the financial markets. The intangible consequences and high uncertainty of investing tempts us to focus more on efficiency than effectiveness in our thinking process. In other words, I believe the rarity of independent thinking is derived from a paucity of patience.

My own recent experience drives this point. I went through some difficult times over the summer, which greatly hampered my emotional capacity. This in turn reduced my ability to focus and diminished my patience. And without patience, I simply could not even sit still and reason each step the way I would normally do for the most important tasks on hand. As a result, for the first time in my adult life, I was described as lacking in independent thinking. However, I am sure I can think independently. Just last summer, we were given a very last-minute option of deferring our start at Columbia Business School. I still remember vividly that I pondered upon this decision very intensely over a weekend in July. It was a very difficult decision. By then I had already quit my job, so if I deferred, I would need to figure out what to do in the next year. On the other hand, having Zoom classes was obviously not ideal. But who knows when things will return to normal? I talked to more than a dozen mentors and discussed it with fellow classmates before ultimately making a decision that was truly my own. My experience was of course not unique. All of my classmates made a decision that best fit their situations and personal goals. It was a clear indication that when it comes to a subject that we care deeply about, we all have the ability to think independently and then make a decision that is right for us. To fully unleash this ability, the key is then to expand our attention, focus, and patience to other domains that are (or subconsciously perceived as) less pressing.

Let us think through "independent thinking" again, this time using the framework of patience. Imagine a person with high emotional stability and an immense amount of patience. When the question of whether Tesla is going to dominate the electric vehicle industry is presented (I just read the latest Worm Capital investor letter which discusses Tesla), first she would be free of the emotions that come along with such a heated debate. Second, without being overwhelmed, she would be emotionally capable of breaking down such a large and complicated question into units of sub-questions through the simple urge to solve a puzzle. Bears say competitors are catching up, and they cite new model launches as evidence. But does new model launches necessarily imply a successful entrance? What should one track and examine to assess whether competitors are catching up? Bulls argue Tesla has a cost advantage with its vertical integration. But does vertical integration necessarily mean lower costs? How does it lower costs? Why doesn’t the automotive industry currently utilize vertical integration if it confers a cost advantage? And so on. With her unhurried and ever-present mind, going through all the above logic will be easy. (She might not be able to find the answers. But again, going through the logic is all independent thinking entails). And with adequate patience, it would be natural for her to go to the source materials and examine the data points accordingly. In fact, she most likely will even enjoy the process!

I believe this interpretation of "independent thinking" bodes well for aspiring investors, because unlike originality, patience can be harnessed, at least to a certain extent.

The Start of My Spiritual Journey

I have been extremely fortunate. While I was going through difficult times, I had support from close friends and mentors. The unifying theme of all the advice I received is that I need to practice self-compassion. The emotional paralysis I experienced in the summer and its dire consequences finally woke me up. I became fully aware that if I do not soon find ways to attain equanimity, I would never achieve sustained happiness and success in life.

So, I began to practice meditation, which now I do every morning. And I picked up the books “The Surrender Experiment” and “The Power of Now”, thanks to the recommendations of two important mentors. The inspiring story of Michael Singer has compelled me to emulate him in surrendering to the flow of life, while Eckhart Tolle’s teaching has opened my mind to, well, the Power of Now. The act of surrendering and staying present-minded frees me from regrets of the past and fear of the future. As a result, I already began to sense that I am becoming more focused on the topic at hand. Being more present minded not only allows me to be more efficient, but it also makes me more patient. I am in much less of a hurry all the time and can think things through more clearly. Fear of being judged and worry of being wrong have both lessened since I now pay less attention to imaginary feelings in the future. The above is all work-in-progress for me. But I believe it will eventually culminate in my improvement as an independent thinker. Ultimately, I hope, paraphrasing Josh, to be “different without expending energy”.

I also resumed journaling. Heeding the advice from another mentor, I now journal around three topics daily: (1) Time allocation in the day. We are what we do regularly. Thus, monitoring how we spend our time on a daily basis is critical. A review at the end of the day gives us a chance to assess our use of the most limited resource and make changes accordingly; (2) Emotional state of the day. Keeping a record of how my emotions fluctuate allows me to catch red flags of a bad emotional trend earlier; and (3) Investment related ideas and learnings. In terms of the medium of taking notes, I find it easiest to do my journaling digitally. I have been using the app Day One, which I think does the job very well.

Conclusion: Temperament Means More Than I Realized

We all know that temperament is more important than intelligence in investing. But we usually say so since temperament determines how well one reacts to fluctuations in stock prices and whether one can stay rational in face of emotional distress. What I did not fully appreciate is how it can also affect one’s research process by influencing independent thinking.

I am happy that I have embarked on this spiritual journey. Regardless of its actual effect on improving my independent thinking, just becoming calmer will be a big plus already. I hope you will join me. But I encourage you to find the way to improve your patience that works best for you.

Finally, I want to thank every person that has supported me over the past few months. I would not have been able to recover as soon as I have without any of you. Thank you all very much.

Really enjoyed the reflection and the post, especially the point about developing independent thinking especially through hard times. Personally, I think the hardest thing is to develop independent thinking and at the same time be right. This requires a great ability to not only listen but also filter the feedback

This is great. Looking forward to more